This portfolio represents a product concept in the ideation stage that aims to revolutionize how consumers access loan products by leveraging their credit history and financial profile to match them with the most favorable lending options available in the market.

The Problem & Opportunity

The Market Gap

The loan application process in India remains fragmented and inefficient. Consumers often accept suboptimal loan terms because they lack visibility into all available options. Meanwhile, financial institutions miss opportunities to connect with qualified borrowers who match their risk profiles.

It may take 1 to 7 days after your application and supporting documents are received for your loan to be approved, and another few days for the funds to be disbursed. This period could change based on the type of lender you choose. Banks may take a few days to a few weeks to process your loan. – Piramal Finance.

Customer Pain Points

- Borrowers lack understanding of how their credit score impacts loan eligibility

- The loan application process is paperwork-intensive and time-consuming

- Consumers often settle for higher interest rates than what they could qualify for

- Limited transparency about available options across the lending ecosystem

- No clear pathway for improving creditworthiness over time

My Vision & Role

As the product manager conceptualizing this solution, my vision is to create a platform that:

- Democratizes access to optimal financial products based on individual credit profiles

- Educates users about their creditworthiness and how to improve it

- Creates a seamless application experience with minimal friction

- Builds a sustainable business model that serves both borrowers and lenders

The Product Concept

Core Value Proposition

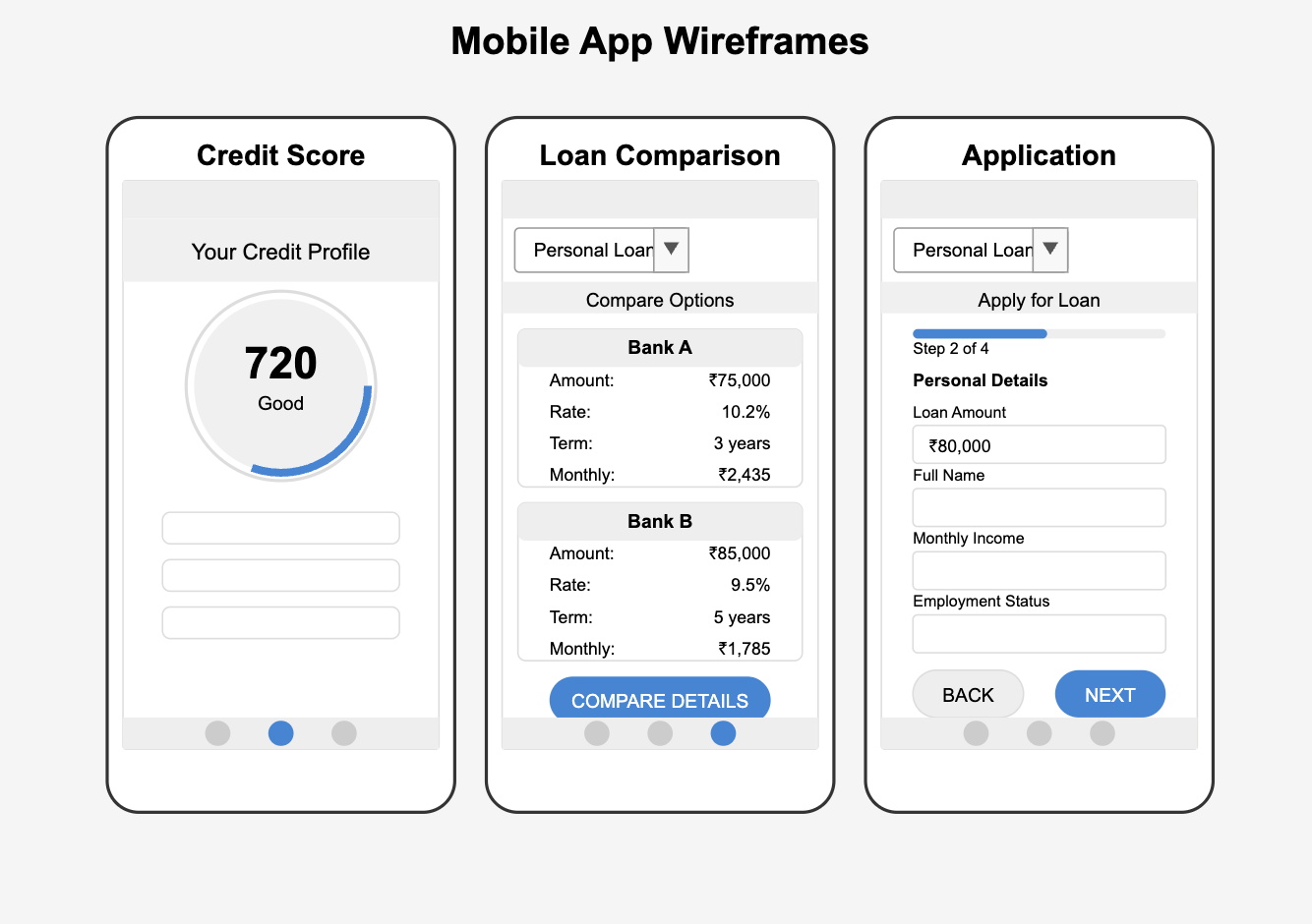

Smart Loan Matchmaker is a mobile-first platform that analyzes users’ credit profiles to match them with personalized loan offerings from multiple banks and NBFCs. The platform goes beyond simple matching by providing a roadmap for credit improvement and expanding loan options as users demonstrate positive repayment behavior.

Key Features

- Credit Profile Analysis

- PAN-based credit score retrieval (CIBIL/Experian)

- Analysis of existing loans and repayment patterns

- Credit health assessment and personalized insights

- PAN-based credit score retrieval (CIBIL/Experian)

- Intelligent Loan Matching

- Curated recommendations from multiple lenders

- Transparent comparison of interest rates and terms

- Eligibility probability indicators

- Curated recommendations from multiple lenders

- Paperless Application Process

- E-KYC integration

- Digital document submission

- Application tracking dashboard

- E-KYC integration

- Credit Improvement Roadmap

- Personalized recommendations for improving credit score

- Future loan opportunity forecasting based on improved scores

- Repayment behavior tracking and positive reinforcement

- Personalized recommendations for improving credit score

Solution Development Approach

User Research Plan

For this concept to succeed, we need to conduct thorough user research focused on:

- Borrower behaviors and pain points across different demographic segments

- Lender requirements and integration challenges

- Regulatory considerations for financial data handling and credit reporting

MVP Definition

The initial version would focus on the core value proposition with these essential features:

- Credit score retrieval and basic analysis

- Matching algorithm for major banks and top NBFCs

- Digital application for select loan products

- Basic credit improvement tips

Technology Stack Considerations

The platform would require:

- Secure integration with credit bureaus (CIBIL/Experian)

- APIs with multiple banking partners

- Robust data encryption and compliance architecture

- User-friendly frontend with clear visualizations

Business Model & Growth Strategy

Monetization Strategy

- Revenue sharing with lending partners for completed loans

- Premium subscription tier for advanced credit monitoring and improvement tools

- Value-added services for financial institutions (data insights, targeted customer acquisition)

Scaling Roadmap

Phase 1: Core Loan Matching

Launch with basic credit analysis and loan matching for personal loans from major banks.

Phase 2: Investment-Backed Loans

Introduce the capability to secure loans against demat account holdings, expanding options for investment-savvy users.

Phase 3: Neo-Banking Integration

Partner with neo-banks to offer embedded loan solutions, creating custom lending products based on aggregate user data.

Product Roadmap

Q1: Concept Validation & Partner Outreach

- Complete user research and validate concept

- Initiate discussions with 3-5 lending partners

- Develop MVP specifications and technical architecture

Q2: MVP Development

- Build core credit analysis engine

- Establish initial banking integrations

- Develop basic user interface and application flow

Q3: Controlled Launch

- Release to limited user base (500-1000 users)

- Gather feedback and iterate on matching algorithm

- Expand lending partner network

Q4: Public Launch & Expansion

- Full market release with marketing campaign

- Add investment-backed loan capabilities

Begin developing neo-banking integration framework

Key Challenges & Mitigations

- Regulatory Compliance

- Challenge: Navigating complex financial regulations around data privacy and lending

- Mitigation: Early consultation with legal experts and phased approach to sensitive features

- Challenge: Navigating complex financial regulations around data privacy and lending

- Lender Integration

- Challenge: Getting banks to participate and integrate with our platform

- Mitigation: Lead with compelling value proposition backed by user data; start with forward-thinking NBFCs

- Challenge: Getting banks to participate and integrate with our platform

- User Trust

- Challenge: Convincing users to share sensitive financial information

- Mitigation: Transparent data policies, educational content, and value demonstration before requiring full profile

- Challenge: Convincing users to share sensitive financial information

Potential Impact & Vision

This platform has the potential to transform financial access in India by:

- Democratizing access to optimal loan products across socioeconomic segments

- Improving financial literacy and credit score awareness

- Reducing friction in the lending ecosystem

- Creating a more competitive marketplace that benefits consumers

In the long term, this could evolve into a comprehensive financial wellness platform that guides users through all aspects of their financial journey.